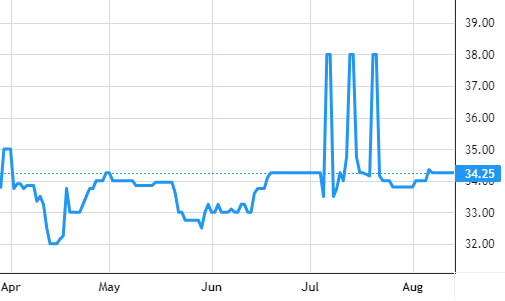

Gereguleerde markten, aangestuurd door Europese en nationale wetgeving, verplichten bedrijven om hun broeikasgasuitstoot te verminderen. CO2-compensatierechten voor compliance-programma’s worden verhandeld als verhandelbare activa en volgen een prijsvorming die vergelijkbaar is met andere grondstoffen. De onderstaande gegevens zijn afkomstig van Tradingview.

Via de aankoop van CO2-credits, geproduceerd door programma’s die gericht zijn op het verminderen of elimineren van broeikasgassen, kunnen bedrijven hun onvermijdelijke uitstoot compenseren binnen de vrijwillige CO2-markt. Organisaties kunnen zelfstandig deelnemen aan deze markt of als onderdeel van een sectorbreed programma. Houd rekening met een mogelijke vertraging van 24 uur in de onderstaande gegevens.

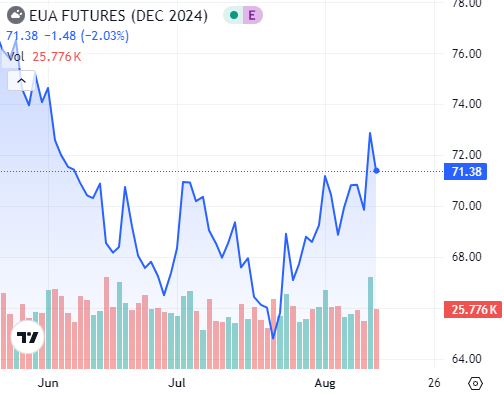

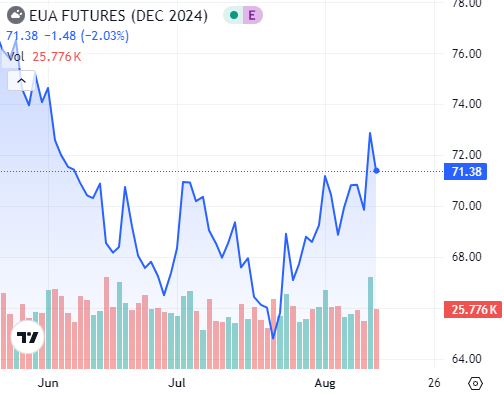

Het emissiehandelssysteem van de Europese Unie is een op de beurs verhandeld koolstofkredietcontract. Voor het verhandelen en verstrekken van EUA’s (European Union Allowance, de officiële naam voor de emissierechten van de regio) is het een termijncontract.

De houder van een EUA mag één ton broeikasgassen uitstoten, zoals CO2 of het equivalent daarvan.

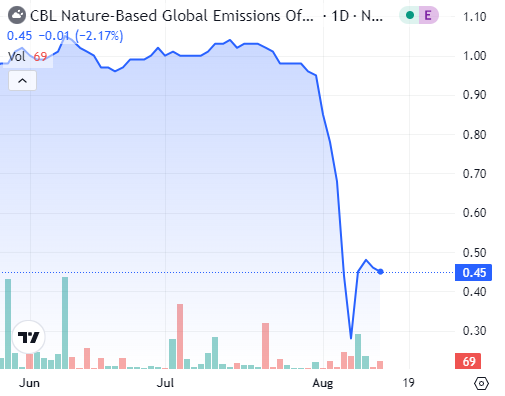

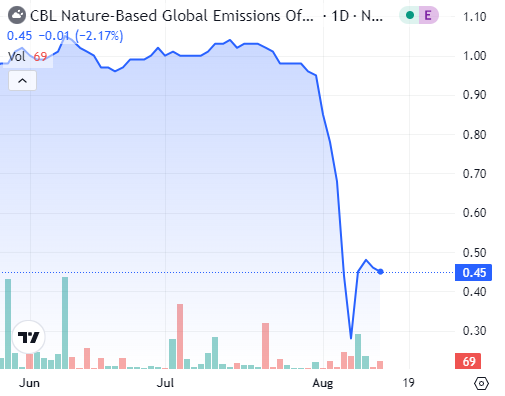

De op de natuur gebaseerde compensatieprojecten uit het Verra-register die passen binnen de categorieën Landbouw, Bosbouw of Ander Landgebruik (AFOLU) vormen de N-GEO termijncontracten.

Hoewel op de natuur gebaseerde oplossingen de biodiversiteit aanzienlijk kunnen vergroten, wordt soms ook gedacht dat het nauwkeuriger bepalen van de hoeveelheid gecompenseerde koolstof in op de natuur gebaseerde projecten een grotere uitdaging is.

De termijncontracten van GEO voldoen aan de CORSIA-standaard van de Internationale Burgerluchtvaartorganisatie. Deze koolstofcompensaties zijn afkomstig van de Climate Action Reserve, de American Carbon Registry en Verra, drie belangrijke registers. vanwege het feit dat de basis bestaat uit eersteklas koolstofkredieten die voldoen aan de eisen van de wereldwijde luchtvaartsector voor het compenseren van emissies. Ze dragen af en toe de naam “Aviation Industry Carbon Offsets”.

Op technologie gebaseerde, niet-AFOLU compensatieprojecten uit het Verra-register die in overeenstemming zijn met de CCP’s vormen de C-GEO termijncontracten. De C staat voor “Core”, oftewel de Core Carbon Principles (CCP’s) van de Taskforce on Scaling Voluntary Carbon Markets. Onder leiding van de Integrity Council for the Voluntary Carbon Markets ontwikkelen de CCP’s een reeks open en uniforme richtlijnen voor het verstrekken van koolstofkredieten. Dit futurescontract voor koolstof is gebaseerd op technologie.

Hoewel koolstofkredieten al jaren op grote schaal worden verkocht op provinciaal en lokaal niveau, heeft China pas in 2021 zijn eigen binnenlandse ETS opgezet.

China’s ETS, het grootste ter wereld in termen van gedekte emissies, is vermoedelijk verantwoordelijk voor meer dan 40% van de nationale koolstofuitstoot (ongeveer 4 miljard tCO2), voornamelijk door de energie-industrie. Verwacht wordt dat het ETS de komende jaren zal worden uitgebreid met andere industrieën en een belangrijke rol zal spelen in de inspanningen van de Chinese overheid om de gevolgen van klimaatverandering te beperken.

Het K-ETS van Zuid-Korea, dat in 2015 van start ging, is het op twee na grootste ter wereld en een van de eerste verplichte emissiehandelssystemen op nationaal niveau. Het dekt ruwweg 75% van de S1+S2 emissies van het land.

De K-ETS, een van de pioniers van de nalevingsmarkten, bevindt zich momenteel in de derde fase van de implementatie; de termijnhandel zal naar verwachting later in 2023 van start gaan en de individuele en internationale deelname zal naar verwachting in 2024 beginnen. De K-ETS zal essentieel zijn voor het bereiken van de nationale doelstelling van Zuid-Korea om in 2050 netto nul emissies te hebben.

Sinds de oprichting in 2008 heeft het NZ ETS in Nieuw-Zeeland drie herzieningen en zeven wijzigingen ondergaan, waaruit blijkt hoe belangrijk het is voor de ambities van de regering op het gebied van klimaatverandering.

Momenteel wordt gewerkt aan een vierde herziening in 2023. Ongeveer de helft van alle broeikasgasemissies in de eilandnatie Nieuw-Zeeland komt voor rekening van het NZ ETS, dat alle belangrijke economische sectoren omvat.

Het feit dat de landbouw verantwoordelijk is voor bijna de helft van de emissies van het land vormt een speciaal probleem voor de regering van Nieuw-Zeeland, die nog steeds bezig is met het afronden van haar systemen voor prijsstelling, rapportage en boekhouding voor haar boeren en telers.

De Australische regering implementeerde voor het eerst een koolstofprijsplan in 2011, maar dat werd in 2014 snel weer ingetrokken. De volgende poging van Australië om een ETS te implementeren zou pas in 2023 plaatsvinden en zou bestaan uit binnenlandse compensatie-achtige producten die Australian Carbon Credit Units, of ACCU’s, worden genoemd.

Hoewel het Australische ETS zich nog in de beginfase van de ontwikkeling bevindt, hebben investeerders en speculanten al geld gestoken in ACCU’s, ook al wordt verwacht dat de benodigde wetgeving pas eind 2023 daadwerkelijk zal worden opgesteld. Degenen die hun geld vullen, verwachten echter dat het onevenwicht tussen vraag en aanbod de prijzen dichter bij het maximum van $75/ton zal brengen, omdat de ACCU-prijzen op dat niveau worden begrensd en jaarlijks stijgen met CPI + 2 procent.